UOB bank is one of the oldest bank in Singapore, and it acquire OUB Bank during the banking consolidation years. I have been using UOB services and products for many years as the bank has strong understanding of Singapore context. A truly Singaporean bank with its fellow citizen concern as its core value.

UOB Income Builder is one of the investment tools build for Singapore Citizen. If you are Singaporean, you should seriously consider this investment tool. Be it for your retirement planning, or for your child education needs, or even for future emergency needs, UOB Income Builder has the solutions for you.

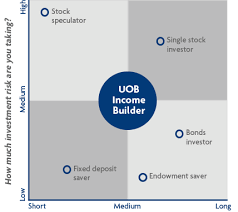

With inflation increasing each year, the saving or fixed deposits interest we are getting from the bank is very small. However, investing in stock poise high risk for many Singapore Citizen with limited financial knowledge. Thus, UOB Income Builder offer the middle ground for us to consider. The Income Builder is a collection of these investment funds (BlackRock Global Multi-Asset Income Fund, JP Morgan Global Income Fund, Schroder ISF Global Multi-Asset Income, United Income Focus Trust and Fidelity Global Multi-Asset Income Fund) chosen by UOB investment specialists. These are diversified funds covering various geographical markets and asset classes and spread across equities, bonds and real estate investment trusts.

Other Online Income Generator

When you are 50 years old and above, you need to start thinking about your retirement needs. For Singapore Citizen who wish to embark on creating business of their own, you may consider to click here for –> other online income generator to learn about alternative option which will provide even more retirement fund for a longer term. There is a growing number of older workers determined not to end their careers when they reach their retirement age, but it depends very much of their employers especially the private sectors which has become very competitive in the globalization era. Therefore, to have better control over our own destiny and income, I strongly suggest to find work that allow us to earn income when we get older and we ourselves determined how much work we want to do each time.

How Much You Need For Your Retirement Fund

Depending on the lifestyle you wish to maintain after your retirement, the amount of retirement fund you need to set aside can be estimated based on your monthly income before retirement.

Take for example, if you wish to retire at the age of 55 and presuming you can live until 80 years old and the health condition throughout that period is not very critical. You can consider the following formula for simple estimation:

- 80-55 = 25 living years

- 25 x 12 months x S$4,000 monthly salary before retirement

- You will need S$1.2 million in your retirement fund

Above estimation have not include the yearly inflation you need to consider, as well as any illnesses you may develop along the years when you get old. More than S$1.2 million may be needed for you to sustain the same lifestyle you wish to maintain before you retire.

This simple estimation will allow you to determine whether you can retire comfortably or not, without any worrying for certain unforeseen circumstances which may need additional or emergency fund to handle them.

Personally I like to take some buffer for safety zone, and when we are not working the income generation will stop and every month there will only be deduction than addition into your retirement. Just like a car, when you continue to drive and consume the petrol every day but do not top up the petrol, you will run out of petrol at one stage and the car will stop.

Same logic when we apply to our lifestyle when you are retire at home without generating any income, the retirement fund will be consumed very fast and we may even not realized it when it deplete in soonest time than what we can imagine.

Is there a suggestion to preserve our retirement fund and have an income generator to create income when you are old and not able to find work anymore?

Yes, with Internet and Online platform, and your years of working experiences and niche knowledge that yourself know better than others, you can continue to earn income to preserve your retirement fund.

Start learning how to use your computer and utilize the internet and Online platform to share the knowledge in your head. When other people appreciate your wise knowledge and years of experiences you acquired in the past, you can still make a living out of it.

This is vital to sustain your retirement fund. Keen to start the path to create your income for the future, click below and start your journey.

Hi! I’m a financial advocate.

I agree to all your insights on this blog. We all do get old and once we do, we stop working. But if you have an online business that you can do at home, retirement would really be fun.

Just like investing, learning the skills in online marketing should also be learned at the earliest possible time to for higher returns in the future, am I making sense?

Yes, the earlier you start learning about Online Business, and know all the techniques and tool to make money online will allow you to earn income early. Your retirement fund can be preserved and continue to earn higher interest, while your online income can use for your daily expenses, and others. I encourage those who want to learn Online Marketing techniques, to visit my home page here and sign up for the free starter membership.

For those want to leverage on Wealthy Affiliate Online Platform effectively, get the premium membership to fully utilize the powerful tool within the system.

Hi Thomas.

i work in a finance field and I agree with your statements. I would encourage everybody to start saving money as soon as he can. From the very first salary. The sooner, the better.

building a second income like an online buisness is a good option too.

Hi Alex,

Thank you for the comment.

Saving money is one option but the best way is continue to earn passive income.

The best Online Business for you to start with is Affiliate Marketing and it allow you to start easily with the right platform I recommed you to explore. Feel free to give it a try. It is a free starter membership program you can sign up for free. By going through the free 10 lesson you will gain a lot of useful knowledge in your financila planning and give you the skill in your life for long time to use.

Best wishes to you and benefit it from this wonderful platform I strongly recommend you to sign up.

Many thanks to you because you posted a very nice article and I really liked your article. I want to do business online but I do not understand how to do business online, After reading the article I got some ideas but still I want to ask you a few questions? I have some idea about affiliate marketing but I want to know what other means besides affiliate marketing is there to earn money online.

Dear Arzu,

Good that you wish to earn money online.

Every business need time and effor to build. However it is worth the effort by building the foundation so you can continue to earn money when you are not working.

Apart from Affiliate marketing which is the most cost effective online business model you can explore, there are many other ways to make money online. Some suggested online survey, freelance blogger, website design for others, provide tuition online.

If you have driving licence, you may consider to drive for Uber and make money online. The job basically come from the internet through your mobile phone. It is consider one of the online money earning method. However, the moment you stop driving, you do not have any income. Therefore, it is a short term way of earning income online.

The best and rewarding method is still creating your Online Business. You have full control of how much you want to earn and it depends very much on your effort. The more you put in your effort, the more money you get back.

I have been in Online Business for various years and I know the power of internet business opportunity. Affiliate marketing is really the most cost effective method to earn money online. There is absolutely no manpower cost, material cost, office rental cost, inventory cost which you need to bear if you choose those traditional busines business.

Start exploring Online Business and create your own Income Generator and compliment that with UOB Income Builder when you have the extra money to invest on this tool.

Thank you so much for the awesome post! This is something that is extremely important, and I am glad you are talking about it. The economy is changing drastically, and inflation is getting worse with the passing of each year. UOB Income Builder seems like something that could potentially help someone in the long run, so they do not suffer from a drastic economic crisis.

Dear Jessie,

You are right that this UOB Income Builder is a useful tool for your investment to generate good income in the year ahead. It is suitable for those who do not have much time to work on other higher income generator.

However, if you are looking for better and higher yield income generator, buidling your own Income Generator with continue effort is much better. You have full control of the amount of income you wish to generate and create long term income for the years to come.

Start your journey in affiliate marketing as one of the best Online Business platform you should consider.

Wow, you provided lots of very helpful information and very thorough explanations. Investing with a long-term, retirement goal in mind is essential. And, I like that you provided the statistics for how to calculate your needs – both in retirement and investing. Thanks so much for the info! Very helpful.

Dear Diane,

I am happy that you gain some useful information from my article. With rising cost in our modern day, we really need to continue earn passive income when we are retired or not working.

$1 million dollar to last for 20 years is not sufficient with current living standard. It is vital that we look for additional income generator. Affiliate Marketing is one of the best Online Business model we can explore and use it to generate additional income on the internet.

Wish you start working on your Online Business and build your passive income much early in your current life.

Thank you so much for sharing with us such a beautiful article .I’ve been working online for a long time .And I have a lot of experience working in this online world .Yes, it was really hard for me after retiring from my job but when I started making money online, my retirement was no longer painful.Wealthy Affiliate is a marketplace where you can easily earn and build your own platform .I know about wealthy affiliate marketing now that it would have been great for me to know anything beyond that .UOB Income Builder Investment Tool is one of my many favorites and articles you admire .

Hi Shanta,

Good to hear that you find my article useful to you. Apart from the UOB Income Builder, you can generate better income by going into Online Business yourself.

By creating your own income generator, you have full control of your income in more years to come and allow you to enjoy more good years ahead.

Go ahead and sign up for the Free Starter program I suggest and you will gain many benefits in your financial planning.

Best wished to you.

I truly need to initially value your exertion in assembling this incredible site and composing this article. I really liked your article. If We as a whole get old and we quit working, that we can an online business that we can do at home. I think Retirement would truly be entertaining. if your retirement fund can be preserved and continue to earn higher interest, while your online income can use for your daily expenses and others. Thank you so much for sharing a beautiful article.

Dear Sabrinamou,

Thank you for the comment. With rising cost it is vital we keep our retirement fund growing year after year.

This UOB Income Builder can help to generate good income for your retirement. However, if you wish to create your own income generator, you can consider to create your Online Business model. The model I suggest here is creating your own website and start putting your own income generator on it.

I have the plafform which you can sign up for free as the starter program, and start putting all the income generator tool on your website. With your chosen niche you love to do in your spare time, you can continue to earn passive income when you are not working.

Sound exciting isn’t it?

Start today and sign up for the free starter progrom now.