When you hear the news talking about the market being “up” or “down,” chances are they’re referring to either the Dow Jones Industrial Average (DJIA) or the S&P 500. But what do these indexes mean? How can understanding them help you make smarter investment decisions, especially if you’re 50 or older?

If you’re at a stage in life where you’re focused on protecting your savings while still growing your wealth, then knowing the difference between these two stock market benchmarks is more important than ever.

Let’s break it all down — in plain English — and look at how both the Dow and the S&P 500 can help you on your investment journey.

What Is the Dow Jones Industrial Average?

The Dow Jones Industrial Average, often simply called “the Dow”, is one of the oldest and most well-known stock market indexes in the world. It was created in 1896 by Charles Dow and originally included just 12 companies.

Today, the Dow tracks 30 large, publicly traded U.S. companies across a variety of industries. These companies are often considered “blue-chip” stocks — big, stable businesses with long histories of success, such as:

- Apple

- Microsoft

- Johnson & Johnson

- Coca-Cola

- McDonald’s

These companies are seen as leaders in their sectors, and the Dow is often viewed as a snapshot of the U.S. economy’s health.

Quick Facts About the Dow:

- 30 companies only

- Weighted by stock price (not size or market value)

- Includes large, established businesses (no small-cap or mid-cap)

- Represents traditional U.S. industries (financials, healthcare, tech, etc.)

What Is the S&P 500?

The S&P 500 — short for Standard & Poor’s 500 — is a much broader market index. It was created in 1957 and includes 500 of the largest companies listed on U.S. stock exchanges.

This index is seen by many experts as the most accurate representation of the overall U.S. stock market and is often used as a benchmark for mutual funds, ETFs, and retirement accounts.

Some of the top companies in the S&P 500 include:

- Amazon

- Google (Alphabet)

- Tesla

- Berkshire Hathaway

- Procter & Gamble

Quick Facts About the S&P 500:

- Includes 500 large U.S. companies

- Weighted by market capitalization (company size)

- More diversified across sectors

- Represents about 80% of the total U.S. stock market value

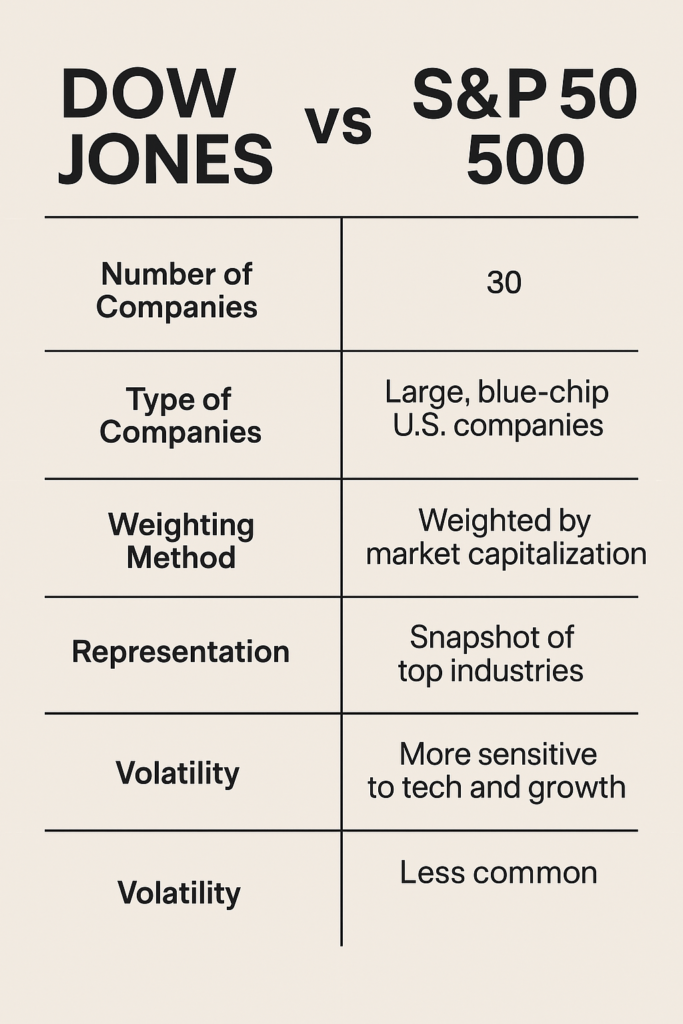

Dow Jones vs S&P 500: The Key Differences

| Feature | Dow Jones (DIA) | S&P 500 |

| Number of Companies | 30 | 500 |

| Type of Companies | Large, Blue-chip U.S. Companies | Large U.S. Companies (more variety) |

| Weighting Method | Stock price | Market Capitalization |

| Representation | Snapshot of top industries | Broader market coverage |

| Volatility | Less volatile | More sensitive to tech and growth |

| Investment Benchmark Use | Less common | Widely used by mutual funds & ETFs |

Why These Indexes Matter for 50+ Investors

If you’re in your 50s or beyond, you’re probably in a different stage of your financial life than when you were 25. Your goals may include:

- Growing your retirement savings steadily

- Avoiding major losses

- Creating passive income

- Preserving capital

Understanding how the Dow and S&P 500 work — and how they perform — can help you choose the right investments for your risk level and long-term goals.

1. The Dow: Stability & Blue-Chip Strength

The Dow is often seen as a more stable index because it tracks companies with long-term track records of profitability and reliability. These are household-name companies that often:

- Pay dividends

- Have predictable earnings

- Are less volatile during market downturns

For 50+ investors:

If you prefer conservative, lower-risk investing, you might lean toward funds or ETFs that track the Dow or invest in its top components.

2. The S&P 500: Growth with Diversification

The S&P 500 offers a wider view of the market, including growth companies in the tech sector that often outperform over time, though with a bit more volatility.

For 50+ investors:

If you’re looking for moderate to strong growth and can stomach a bit more risk, the S&P 500 offers broad market exposure and diversification, which helps reduce risk over the long run.

Real-Life Investment Options: How You Can Use These Indexes

You don’t have to pick individual stocks to invest in the Dow or S&P 500. In fact, for most investors — especially those over 50 — a low-cost index fund or ETF is often the smartest choice.

Example: S&P 500 Index Funds

- Vanguard 500 Index Fund (VFIAX)

- SPDR S&P 500 ETF (SPY)

- Fidelity 500 Index Fund (FXAIX)

These funds mirror the performance of the S&P 500 and offer low fees, instant diversification, and strong long-term performance.

Example: Dow Jones ETFs

- SPDR Dow Jones Industrial Average ETF (DIA)

- iShares Dow Jones U.S. ETF (IYY)

These ETFs are great for those seeking blue-chip strength and more predictable dividend income.

How Have These Indexes Performed Over Time?

S&P 500:

Historically returns about 10% per year on average (before inflation). However, this includes bull markets and bear markets, and performance varies year to year.

Dow Jones:

Long-term average return is slightly lower, around 7–9%, due to its more conservative composition and price-weighted calculation.

Still, both have proven to be resilient long-term investments, outperforming most active fund managers over 10–15 years.

What Should 50+ Investors Consider?

You’ve likely heard the saying: “Time in the market beats timing the market.” At 50 or older, time becomes more valuable, but there’s still plenty of room to grow your money wisely — especially with the right strategy.

Here’s how to approach investing with these indexes at this life stage:

1. Know Your Risk Tolerance

Are you more concerned with preserving your capital or growing it?

Dow = more stable, conservative

S&P 500 = broader exposure, more potential growth

2. Diversify

You can own both! A common strategy is to split your portfolio — perhaps 50% in S&P 500 index funds and 50% in more stable dividend-paying companies (some of which are part of the Dow).

3. Focus on Fees

Index funds and ETFs that follow the Dow or S&P 500 often have very low fees, which is crucial because high fees eat into your returns, especially over a long retirement.

4. Think Long-Term

Even in your 50s or 60s, you may have 20–30 years of investing ahead of you. Don’t let short-term market fear stop you from building a solid foundation.

5. Consider Dividends

Some Dow companies pay solid dividends, which means they provide regular income in addition to price appreciation. This is especially attractive during retirement years.

Final Thoughts: Which Index Is Right for You?

The truth is, both the Dow Jones and the S&P 500 offer value, just in different ways.

If you want:

- Stability, income, and less volatility → Consider Dow-based investments

- Broader growth and full-market exposure → Consider S&P 500-based investments

- A bit of both → Diversify and mix them in your portfolio

The good news is, you don’t have to choose just one. Many smart investors 50 and older use both to balance risk and reward, and to help them sleep better at night.

You’re Not Too Late to Start

If you’re just beginning to invest in your 50s, don’t be discouraged. The most important thing is to start now, with a strategy that aligns with your goals, values, and lifestyle.

These index funds and ETFs provide a simple, low-cost, and time-tested way to grow your money for the years ahead.

And remember — knowledge is power. You’ve got decades of life experience. Now you have investment insight too.

Let this be the beginning of a stronger financial future — one where you’re in control.